Introduction: The Strategic Imperative of Generic Drugs

The pharmaceutical landscape is a complex tapestry woven with threads of innovation, accessibility, and economic sustainability. At its core, generic drug product development represents a crucial, often understated, pillar supporting global healthcare systems. These medications are not merely cheaper alternatives; they are the bedrock upon which accessible and affordable healthcare is built, significantly alleviating the financial burden on patients, healthcare providers, and national health systems. Understanding their intricate development and regulatory pathways is paramount for business professionals aiming to navigate and dominate this vital sector.

Why Generics Matter: Economic Impact and Patient Access

The economic impact of generic drugs is profound and far-reaching. Consider the sheer scale of savings they generate: in 2021, generic and biosimilar drugs collectively saved the U.S. healthcare system a remarkable $373 billion.1 This figure represents a significant increase from $338 billion in 2020, underscoring a consistent and growing trend in cost containment.1 Looking back, the U.S. healthcare system realized an astounding $1.67 trillion in savings over the decade leading up to 2016, directly attributable to the widespread availability of low-cost generics.2 These figures are not abstract; they translate into tangible benefits for millions.

For individual patients, the financial relief is immediate and substantial. The average copay for a generic prescription stands at approximately $6.16, a stark contrast to the average brand-name drug copay, which can exceed $56.12.1 This affordability is further highlighted by the fact that 93% of generic prescriptions cost under $20.1 Such a significant reduction in out-of-pocket expenses directly enhances patient access to essential medications and improves adherence to prescribed treatments, ultimately leading to better public health outcomes. As Brent Eberle, president of CivicaScript, aptly articulated, “It’s important to always remember that about nine out of every 10 prescriptions are filled for a generic product”.3 This statement powerfully illustrates the ubiquitous and indispensable role generics play in the daily lives of patients worldwide.

The consistent and substantial savings generated by generic drugs extend beyond mere cost reduction; they create a critical economic “headroom” within the broader healthcare system. This financial flexibility allows for the reallocation of resources towards other vital areas, particularly the research and development of novel, innovative therapies for unmet medical needs. By making established treatments affordable, generics indirectly support the high-cost, high-risk endeavors of brand-name drug discovery. This creates a symbiotic relationship: a thriving generic market provides the financial sustainability that enables the innovative sector to continue pushing the boundaries of medical science. This dynamic suggests that policies promoting generic competition are not anti-innovation; rather, they foster a more balanced and sustainable pharmaceutical ecosystem.

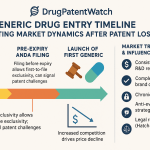

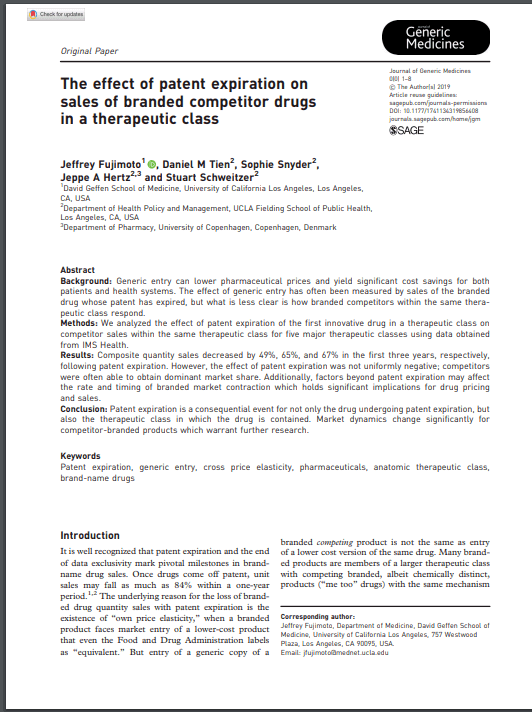

The expansion of the generic market is fundamentally driven by the expiration of patents on brand-name drugs. When a brand-name drug’s patent expires, it opens the door for generic manufacturers to enter the market, introducing competition. This direct cause-and-effect relationship leads to a significant reduction in drug prices. For instance, the entry of a single generic competitor can reduce prices by 30%, while the presence of five generic competitors can lead to price drops of nearly 85%.4 This increased affordability directly enhances patient access. The projected global generic drugs market size, which is estimated to reach $775.61 billion by 2033 5, is a direct consequence of this ongoing cycle of patent expiries and subsequent generic entry. For businesses, this highlights the strategic imperative of robust patent monitoring and the pursuit of “first-to-file” strategies to capitalize on the lucrative initial exclusivity period that often follows patent expiry.6

Navigating the Complexities: A Roadmap for Business Professionals

Despite their widespread use and perceived simplicity, the development and regulatory approval of generic drugs are far from straightforward. This process is a highly intricate and demanding endeavor, requiring meticulous navigation through a complex array of scientific, technical, and legal requirements. For business professionals, a superficial understanding of this domain is simply insufficient. True market leadership in the generic pharmaceutical sector demands a deep, nuanced comprehension of every stage, from the initial concept and reverse engineering of the innovator product to the rigorous post-market surveillance.

This report aims to provide precisely that comprehensive roadmap. It will delve into the critical phases of generic drug development, illuminating the distinct yet interconnected regulatory pathways established by key authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Furthermore, it will dissect the strategic challenges and unparalleled opportunities that define this dynamic industry. The ultimate goal is to equip readers with the actionable insights necessary to make informed decisions, identify sustainable competitive advantages, and effectively contribute to market leadership in the ever-evolving generic pharmaceutical landscape.

The Generic Drug Development Lifecycle: From Concept to Commercialization

The development of a generic drug product, while often referred to as “abbreviated” when compared to the extensive journey of a novel drug, is nonetheless a rigorous, multi-stage process. Its primary distinction lies in its reliance on demonstrating bioequivalence to an already approved Reference Listed Drug (RLD), rather than undertaking comprehensive de novo clinical trials for safety and efficacy.8 This abbreviated pathway, however, does not diminish the scientific rigor or the regulatory complexities involved in bringing a generic product to market.

Phase 1: Pre-Formulation and Reference Product Characterization

The foundational step in generic drug development is the meticulous “reverse engineering” or “deformulation” of the innovator’s Reference Listed Drug (RLD).10 This critical process involves a detailed analytical breakdown to identify and quantify every component within the RLD, encompassing both the active pharmaceutical ingredient (API) and all inactive excipients.10 It is, in essence, a scientific deconstruction of the original product to fully comprehend its intrinsic blueprint.

The overarching objective of this reverse engineering is to achieve what regulatory bodies term Q1, Q2, and Q3 equivalence with the RLD.11 Q1 equivalence signifies qualitative sameness, meaning the generic formulation contains the identical API and excipients as the innovator product.11 Q2 equivalence progresses to quantitative sameness, requiring the generic’s composition to match the innovator’s within a tight margin, typically ±5%.11 Finally, Q3 similarity represents the most comprehensive level of equivalence, demanding not only identical components at the same concentration but also the maintenance of the same microstructure, with components exhibiting equivalent physical and chemical properties.11 This exhaustive characterization serves a dual purpose: it supports regulatory submissions by providing a robust scientific foundation, and it acts as a crucial developmental guide, allowing generic manufacturers to significantly reduce the number of experimental trials required to optimize their own formulation, thereby streamlining the entire development process.11

The emphasis on detailed deformulation and the pursuit of Q1/Q2/Q3 equivalence are critical steps that can significantly reduce development risks and optimize formulation.11 This deep, early-stage understanding of the RLD’s composition and performance has a direct and profound impact on the development timeline. For generic drug companies, an upfront investment in sophisticated analytical techniques and specialized expertise for RLD characterization is a strategic imperative. By precisely understanding the innovator’s product, manufacturers can proactively identify potential formulation challenges, minimize costly trial-and-error iterations, and accelerate their path to achieving bioequivalence. This directly translates into a faster time-to-market, which is a critical competitive advantage, particularly for companies aiming to be the “first-to-file” and capture the lucrative 180-day exclusivity period.6 It exemplifies the principle of “measure twice, cut once” in a high-stakes industry, where thorough initial work can yield substantial long-term benefits.

Critical Pre-Formulation Studies: Solubility, Stability, and Excipient Compatibility

Once the RLD has been thoroughly deconstructed, the focus shifts to detailed pre-formulation studies of the active pharmaceutical ingredient (API) itself. These studies are foundational for the rational design of any pharmaceutical formulation.14 They delve into the intrinsic physical and chemical properties of the API, predicting its behavior and potential interactions within a dosage form.

Solubility is a paramount property, as it directly dictates how effectively a drug dissolves and is absorbed into the body, thereby profoundly impacting its bioavailability.14 Pre-formulation studies meticulously evaluate how well the API dissolves in various solvents and under different pH conditions, optimizing this property to ensure efficient delivery to the site of action.14 Poor solubility can significantly reduce therapeutic effectiveness, making early identification and optimization of solubility crucial.

Polymorphism refers to the ability of a drug substance to exist in multiple crystalline forms. Each polymorphic form can possess distinct physical and chemical properties, such as differing solubility, dissolution rates, or stability profiles.14 Identifying and characterizing these polymorphs is crucial for selecting the optimal form that ensures consistent drug performance throughout its lifecycle, from manufacturing to patient use. Even minor variations in crystalline structure can affect a drug’s overall performance, necessitating this detailed analysis.

Pre-formulation stability studies are designed to predict the drug’s shelf life and guarantee its continued safety and efficacy over time.14 These early tests expose the API to various environmental stressors like elevated temperature, humidity, and light, allowing developers to identify the most stable formulations and make necessary adjustments before committing to large-scale manufacturing. This proactive approach mitigates risks related to degradation or loss of potency later in the development process.

Excipient compatibility testing is another vital step. It assesses how the API interacts with inactive substances (excipients) used in the formulation.14 Incompatibilities can lead to reduced potency, accelerated degradation, or even adverse patient reactions.14 Identifying the best combinations of ingredients ensures a safe, stable, and effective final drug product that works harmoniously with both active and inactive components.14

Finally, the particle size distribution of the API is carefully optimized. The size of drug particles profoundly influences various aspects of drug performance, including absorption rates, dissolution rates, and manufacturability.14 Striking the right balance is key: particles that are too large may dissolve too slowly, reducing bioavailability, while excessively small particles can pose challenges during production, such as poor flowability or content uniformity issues.14 Optimizing particle size early in the development process helps achieve the right balance between performance and manufacturing efficiency.

Phase 2: Formulation Development and Optimization

Armed with comprehensive insights from RLD characterization and pre-formulation studies, the next critical phase involves the actual development of the generic formulation. This stage is a sophisticated blend of scientific expertise and innovative problem-solving, focused on creating a pharmaceutically equivalent product that also achieves bioequivalence with the reference product.16 The goal is to ensure the generic drug contains the same active substance, is in the same pharmaceutical form, and is intended for the same therapeutic indications, all while demonstrating a similar bioequivalence (typically within a ±20% range) relative to the RLD.17

A successful formulation meticulously combines the active pharmaceutical ingredient (API) with carefully selected inactive excipients.13 These excipients are far more than inert fillers; they often play functional roles, such as controlling drug release mechanisms, enhancing stability, or ensuring the drug reaches its intended site of action within the body.13 Ensuring compatibility between the chosen excipients and the API is paramount to guarantee that the correct dose is delivered consistently within the required therapeutic window.13 Physicochemical analysis aids in excipient selection, enabling the assessment of drug substance and product stability.

Regulatory bodies, recognizing the inherent complexities, particularly for non-simple generics, actively issue product-specific guidance to aid in this intricate process.13 This guidance often emphasizes the assessment of physicochemical (Q3) equivalence as an integral part of the overall bioequivalence evaluation.13 This focus on Q3 equivalence, which involves detailed structural and morphological characterization of the API and excipients, plays a critical role in successful

in vitro bioequivalence studies, potentially reducing the need for clinical endpoint studies.13

The adoption of Quality by Design (QbD) principles is increasingly encouraged in this phase. QbD provides a systematic, risk-based approach to identify critical quality attributes (CQAs) of the product and critical process parameters (CPPs) of manufacturing.16 It establishes a scientific relationship between formulation and manufacturing variables (including drug substance and excipient attributes, and process parameters) and the final product quality.16 By implementing QbD, sponsors can more effectively identify and adjust formulation and manufacturing variables to consistently produce a bioequivalent product, potentially accelerating development and approval and limiting unnecessary human testing.16

The convergence of regulatory guidance and scientific methodology points to a strategic evolution in generic drug development. The industry is increasingly leveraging advanced analytical techniques and a deeper, more predictive understanding of product characteristics (through QbD) to establish bioequivalence using in vitro methods, thereby potentially reducing reliance on costly and time-consuming in vivo human studies. For generic manufacturers, this means that investing in sophisticated analytical instrumentation, computational modeling capabilities, and a robust QbD framework is no longer just about compliance, but a significant competitive differentiator. It enables faster development cycles, reduced costs, and quicker market entry, providing a substantial advantage in a competitive landscape.

Process Development and Manufacturing Excellence

Beyond the formulation itself, developing a consistent, robust, and scalable manufacturing process is paramount. This phase focuses on optimizing every step to ensure the drug product can be consistently produced with the desired attributes and quality, batch after batch.16 Early in development, all possible synthesis routes are reviewed to select the most suitable chemistry, setting the foundation for future optimization.18 This proactive approach aims to avoid discovering new impurities at later stages of manufacturing.18

Optimization efforts during process development are multi-faceted, aiming for efficiency and cost-effectiveness. This includes: achieving high yields; minimizing or eliminating the use of harsh or dangerous chemicals; selecting better or fewer solvents to reduce environmental impact and cost; and potentially re-routing the chemical synthesis to reduce the number of steps, thereby saving time and resources.19 Furthermore, optimizing critical process parameters such as temperature, pH, dissolved oxygen levels, and feed rates is crucial, often utilizing sophisticated Design of Experiment (DoE) approaches to systematically identify optimal conditions.20 Early screening of equipment using small-scale models like shake flasks or microtiter plates can facilitate initial optimization.20

A significant challenge lies in the transition from small-scale laboratory production (milligram to gram scale) to larger, commercial-scale manufacturing (kilogram scale and beyond).19 This “scale-up” process requires meticulous planning, rigorous validation, and careful adjustments to ensure that product specifications and quality standards are consistently met at larger volumes.20 The manufacturing process used for initial batches must accurately simulate that intended for full-scale production, ensuring the final product maintains the same quality and consistency.22

The ability to rapidly and cost-effectively scale up production is not merely an operational detail for generic manufacturers; it is a critical strategic lever for capitalizing on market opportunities immediately following patent expiry. Inefficient scale-up or unexpected manufacturing issues can lead to significant delays, eroding the crucial “first-to-file” advantage and severely impacting profitability.6 Therefore, strategic investment in robust process development, advanced manufacturing technologies (such as continuous manufacturing, 3D printing, and automation 23), and skilled engineering teams is essential. This proactive approach transforms manufacturing from a potential bottleneck into a competitive advantage, enabling quicker market entry and sustained supply.

Phase 3: Analytical Method Development and Validation

Analytical method development and subsequent validation are fundamental pillars supporting the entire drug development lifecycle, particularly for generic pharmaceuticals. These methods serve as the scientific instruments used to precisely identify, separate, and quantify the chemical components within medicinal compounds, thereby establishing their identity, purity, physical characteristics, and potency.26 They are also crucial for accurately assessing a drug’s bioavailability and stability over time.26

The core purpose of analytical method development is to establish highly precise and reliable assay procedures that can accurately determine the exact composition of a drug.26 Once developed, these methods must undergo rigorous validation to unequivocally demonstrate their suitability for their intended purpose of assessing drug quality.26 Key validation parameters that must be evaluated include:

- Specificity: The ability to accurately measure the analyte in the presence of other components, ensuring no interference from excipients or degradation products.26

- Limit of Detection (LOD): The lowest concentration of an analyte that can be reliably detected, crucial for impurity testing.26

- Limit of Quantitation (LOQ): The lowest concentration of an analyte that can be quantitatively determined with acceptable precision and accuracy.26

- Linearity: The ability to obtain test results directly proportional to the concentration of the analyte within a given range, ensuring accurate quantification across various concentrations.26

- Accuracy: The closeness of test results to the true value, indicating how well the method measures what it’s supposed to.26

- Range: The interval between the upper and lower concentrations for which the method has been validated, defining its applicability.26

- Precision: The degree of agreement among individual test results when the method is applied repeatedly, reflecting the method’s reproducibility.26

- Stability: The ability of the method to remain unaffected by small, deliberate variations in method parameters, demonstrating its robustness.26

This emphasis on analytical precision is not merely a technical detail or a compliance burden; it is a fundamental gatekeeper for market access and a direct determinant of public health. For business professionals, this translates into a critical strategic understanding: underinvesting in analytical development or validation is a false economy. Such shortcuts invariably lead to regulatory rejections, costly delays in market entry, and potential patient harm, severely damaging brand reputation and long-term profitability. Therefore, prioritizing investment in state-of-the-art analytical instrumentation, advanced methodologies, and highly skilled analytical personnel is a strategic necessity, not an optional expense, to ensure both regulatory success and sustained market trust.

Adhering to Global Standards: ICH Guidelines and Beyond

To ensure global consistency and quality, pharmaceutical method development and validation must strictly adhere to international guidelines. Key among these are the directives issued by the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), alongside specific guidelines from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).26 Notably, both the FDA and the U.S. Pharmacopoeia (USP) frequently reference and align with ICH guidelines.26

Specific ICH guidelines, such as ICH Q2(R1) (“Validation of Analytical Procedures: Text and Methodology”) and the upcoming ICH Q14, provide the foundational framework for robust analytical validation.27 Beyond these, compliance with Good Manufacturing Practice (GMP) and Good Laboratory Practice (GLP) directives is mandatory to ensure the integrity of data and the quality of the manufacturing process.26

The FDA plays a proactive role by publishing Product-Specific Guidances (PSGs). These documents articulate the agency’s current scientific thinking and expectations regarding appropriate methodologies for developing generic drugs and generating the necessary evidence to support Abbreviated New Drug Application (ANDA) approval.28 The strategic value of these PSGs is significant; they can substantially reduce development costs, with one estimate suggesting a 22.3% reduction, translating to approximately $25.9 million per product for complex generics.29

The widespread adoption of ICH guidelines by both FDA and EMA 26 and the explicit mention of FDA’s Product-Specific Guidances 28 indicate a deliberate move by regulatory bodies towards greater clarity, predictability, and standardization in their expectations for generic drug development. The fact that PSGs are noted for potentially cutting development costs 29 reinforces their strategic importance. This trend signifies that regulatory bodies are actively seeking to de-risk and streamline generic drug development. For pharmaceutical companies, proactively engaging with these harmonized guidelines and leveraging PSGs is not just about compliance; it is a strategic imperative for optimizing resource allocation, reducing development timelines, and accelerating approvals. It is akin to having a detailed, agency-approved blueprint for navigating the development process, allowing companies to proceed with greater confidence and efficiency. This also highlights the growing importance of strong regulatory intelligence functions within generic pharmaceutical companies to identify and capitalize on these evolving guidelines.

Phase 4: Bioequivalence Studies: The Cornerstone of Generic Approval

Bioequivalence (BE) studies stand as the most pivotal and non-negotiable component of generic drug development. Their fundamental objective is to scientifically prove that a generic drug (referred to as the “test product”) is therapeutically interchangeable with its innovator (brand-name) counterpart (the “reference product”).31 This means the generic must reliably produce the same therapeutic effect and exhibit an equivalent safety profile as the original brand-name drug.31

These studies primarily focus on comparing pharmacokinetic (PK) parameters, which quantitatively describe how the drug is absorbed, distributed, metabolized, and excreted within the body.31 The most critical parameters evaluated are:

- Area Under the Curve (AUC): This represents the total systemic exposure to the drug over time. It is calculated by integrating the drug concentration-time curve and primarily reflects the extent of drug absorption and overall bioavailability.31

- Maximum Concentration (Cmax): This indicates the peak concentration of the drug achieved in the bloodstream after administration. It provides insights into the rate and extent of drug absorption.31

- Time to Maximum Concentration (Tmax): The specific time point at which the drug reaches its peak concentration in the bloodstream.32

For a generic drug to be deemed bioequivalent, the 90% confidence interval (CI) for the ratio of the geometric means of the test product’s AUC and Cmax to the reference product’s AUC and Cmax must typically fall within a narrow acceptance range of 80% to 125%.31

The most common study designs employed are randomized, two-period, two-sequence, single-dose crossover studies, typically conducted in healthy human volunteers.31 This crossover design is particularly effective as it allows each subject to receive both the test and reference products, minimizing inter-individual variability and enhancing the precision of the comparison.31 Furthermore, studies are frequently conducted under both fasting and fed conditions to assess any potential impact of food on drug absorption.32

While the research consistently states that demonstrating bioequivalence is a “key step in establishing therapeutic equivalence” 31 and that regulatory agencies mandate it to ensure “safety, efficacy, and quality” 31, a critical counterpoint exists. Some perspectives suggest that generic drugs are not necessarily therapeutically equivalent to branded drugs because extensive safety and efficacy testing is not required beyond bioequivalence.17 There have even been anecdotal cases of clinical failure or adverse effects when patients switched from brand to generic formulations, such as with ciprofloxacin.17 This highlights a crucial nuance for both business professionals and healthcare providers. While the regulatory framework for bioequivalence is robust and designed to ensure interchangeability, real-world patient responses, particularly for complex drugs or sensitive patient populations, can sometimes present unexpected challenges. This underscores that while bioequivalence is the scientific standard for approval, continuous post-market surveillance and pharmacovigilance (which the FDA actively conducts 36) are absolutely vital for ongoing safety monitoring. For generic manufacturers, this observation suggests that merely meeting the 80-125% bioequivalence window might not always be enough to ensure universal patient satisfaction or to avoid rare but significant adverse event reports. It subtly encourages a focus on “higher-value generics” 37 that might offer additional assurances or address specific patient sensitivities, thereby building deeper trust and minimizing potential clinical discrepancies.

Navigating Regulatory Expectations: FDA and EMA Bioequivalence Guidelines

Regulatory agencies across the globe, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), unequivocally mandate bioequivalence studies as a prerequisite for generic drug approval.31 These agencies provide comprehensive and specific guidelines that dictate the design of these studies, including details on the study population, duration, and the statistical methods to be employed.31

The FDA proactively supports generic drug development by publishing Product-Specific Guidances (PSGs). These documents articulate the agency’s current scientific thinking and expectations regarding appropriate methodologies for conducting bioequivalence studies for various drug products.28 Similarly, the EMA issues its own product-specific guidance, particularly for generic applications, which are applicable across all European regulatory submission routes (e.g., centralized, decentralized, mutual recognition, or national procedures).39

A significant step towards global harmonization in this area is the ICH M13A Guideline. Effective January 25, 2025, this guideline provides harmonized recommendations for conducting bioequivalence studies for orally administered immediate-release solid oral dosage forms.30 This international alignment aims to streamline development and approval processes across different regulatory jurisdictions, ultimately facilitating faster global market access for generic drugs.40

The ICH M13A guideline, by providing harmonized recommendations for bioequivalence studies and superseding applicable parts of the EMA Guideline on the investigation of bioequivalence 30, directly implies a concerted international effort to standardize BE requirements. For generic drug companies with global aspirations, harmonized bioequivalence standards represent a significant opportunity. They promise reduced duplication of studies and data packages across different regions, which can lead to substantial reductions in R&D costs and accelerated timelines for multi-market entry. This encourages companies to design their BE studies with global regulatory expectations in mind from the very outset, rather than having to adapt or repeat studies for each individual market. Ultimately, this trend fosters a more efficient global generic drug supply chain, improving worldwide access to affordable medicines and creating a more predictable regulatory environment for international players.

Table 1: Key Pharmacokinetic Parameters and Bioequivalence Acceptance Criteria

To further clarify the scientific underpinnings of bioequivalence, the following table outlines the key pharmacokinetic parameters and the typical acceptance criteria mandated by regulatory bodies like the FDA and EMA.

| Parameter | Definition | Typical Acceptance Criteria for Bioequivalence (90% Confidence Interval of Geometric Mean Ratio, Test vs. Reference) | Regulatory Bodies |

| AUC (Area Under the Curve) | Total drug exposure over time, reflecting the extent of absorption and overall bioavailability. | 80% – 125% | FDA, EMA (and others adhering to ICH) 31 |

| Cmax (Maximum Concentration) | Peak drug concentration in the bloodstream, reflecting the rate and extent of drug absorption. | 80% – 125% | FDA, EMA (and others adhering to ICH) 31 |

| Tmax (Time to Maximum Concentration) | Time taken for the drug to reach peak concentration in the bloodstream. | Typically assessed for clinical relevance but does not have a strict acceptance interval for BE. | FDA, EMA (and others adhering to ICH) 32 |

Pharmacokinetic parameters like AUC and Cmax are highly technical terms that are central to understanding bioequivalence. For a business professional audience, a clear, concise table defining these and presenting the critical 80-125% acceptance range immediately demystifies this complex scientific requirement. It transforms abstract concepts into concrete, digestible information. The table visually represents the stringent quantitative “goalposts” that generic drugs must meet to gain regulatory approval. This visual clarity is often more impactful than lengthy textual descriptions, helping the audience quickly grasp the scientific rigor involved. For investors, R&D managers, or market strategists, understanding these specific criteria is crucial for evaluating the scientific feasibility and risk associated with a generic drug candidate. It provides a quick reference for what constitutes “successful” bioequivalence from a regulatory standpoint, enabling better assessment of development pipelines.

Phase 5: Quality Control, Assurance, and Stability Testing

In the pharmaceutical industry, quality is not merely a desirable attribute; it is an absolute mandate. Generic drugs, without exception, are held to the identical rigorous quality standards as their brand-name counterparts.41 This unwavering commitment to quality is primarily enforced through adherence to

Good Manufacturing Practices (GMP), often referred to as Current Good Manufacturing Practice (cGMP) in the United States.43 GMP regulations legally require manufacturers to demonstrate the safety, purity, and efficacy of their drug products throughout their entire lifecycle, from the earliest stages of clinical testing through post-market availability.43

GMP encompasses an extensive array of requirements designed to ensure consistent quality. These include: establishing and maintaining suitable Quality Management Systems (QMS); ensuring the integrity and traceability of all materials used; implementing appropriate and validated operational processes; and maintaining compliant laboratory facilities to support product characterization and testing.43 The scope of GMP is remarkably broad, spanning from the proper maintenance and calibration of manufacturing equipment to the acceptable performance of analytical tests that measure drug purity.43 Ultimately, these regulations are designed to address the full manufacturing process, maintain the quality of drug products, and, most importantly, protect consumers.43

A robust Quality Management System (QMS) serves as the foundational organizational framework that enables pharmaceutical companies to consistently design, produce, and control products that meet predefined criteria for efficacy, safety, and quality.45 Beyond mere regulatory compliance, a well-implemented QMS fosters a culture of continuous improvement and enhances customer satisfaction.45 It integrates critical components such as document management, corrective and preventive actions (CAPA), and comprehensive training management, overseeing every stage from initial development to final distribution.45 This structured approach allows companies to proactively assess process effectiveness, identify opportunities for enhancement, and mitigate potential risks before they escalate into significant issues.45

While GMP focuses on individual product quality 43, the broader QMS integrates processes across the entire product lifecycle.45 The challenges of “quality issues” in generic development 46 and the importance of “quality and batch release processes with digitization and predictive intelligence” for optimizing the supply chain 47 underscore the critical need for consistent quality. Furthermore, the FDA’s role in monitoring the global supply chain and inspecting manufacturing plants 36 highlights the necessity of robust quality systems. In today’s increasingly globalized and complex pharmaceutical supply chain, where a significant portion of active pharmaceutical ingredients (APIs) is sourced internationally (over 70% 49), robust GMP and a mature QMS are no longer just regulatory obligations; they are strategic assets. These systems are crucial for building and maintaining consumer and prescriber trust, mitigating the severe risks of product recalls (which can devastate a brand’s reputation and profitability 50), and ensuring the resilience of the supply chain against disruptions like ingredient shortages or quality lapses.46 For business leaders, this implies that investing in state-of-the-art quality systems, fostering a strong quality culture, and ensuring rigorous GMP compliance across their entire global manufacturing and supply network is critical for long-term market stability, competitive differentiation, and safeguarding public health. This also aligns with the broader push for “prioritized quality” within the supply chain to prevent drug shortages.51

Predicting Longevity: Comprehensive Stability Studies

Stability testing is an indispensable component of pharmaceutical development, designed to rigorously assess how a drug product maintains its identity, potency, purity, and overall integrity over its intended shelf life.14 These studies involve exposing the drug to various environmental conditions, including controlled temperature, humidity, and light, to simulate real-world storage scenarios.14 The primary goal is to ensure that the product remains safe and effective throughout its entire shelf life, providing confidence in its quality from manufacturing to patient use.52

Regulatory bodies like the FDA and EMA provide detailed and increasingly stringent guidelines for stability testing.52 For instance, the FDA typically requires stability data on at least three primary batches for new non-prescription drug products regulated by an ANDA.22 Testing is usually conducted at regular intervals, such as 0, 3, 6, 9, 12, 18, 24 months, and annually thereafter through the proposed shelf-life.22 These tests evaluate physical, chemical, biological, and microbiological attributes, as well as functionality tests for dose delivery systems.22

Study designs often employ sophisticated approaches like “bracketing” and “matrixing” to make the testing process more efficient while maintaining scientific rigor.52 Bracketing involves testing only the extremes of a product’s strength or container size, assuming intermediate strengths or sizes will have similar stability.52 Matrixing, on the other hand, involves testing a subset of samples, assuming their stability represents the stability of all samples at a given time point.52 Analytical methods used in stability testing must be “stability-indicating,” meaning they can accurately differentiate between the intact drug molecule and its degradation products, ensuring precise monitoring of quality attributes over time.52 The container closure system proposed for marketing must also be used in these tests, reflecting real-world conditions.52

A notable observation is that both the EMA and FDA are increasing their requirements for stability testing, particularly for generic drugs.53 For example, the FDA will soon require 12 months of product stability data with Abbreviated New Drug Applications (ANDAs), which is four times longer than previously mandated.53 This adjustment brings the stringency of stability tests for generics closer to what is required for original marketing authorizations.53 This increased regulatory scrutiny means generic manufacturers must allocate more time and resources to stability studies, potentially lengthening development timelines and increasing costs.53 For businesses, this necessitates earlier and more robust planning for stability programs, potentially impacting the “first-to-file” race. It also reinforces the overall trend of regulators demanding more comprehensive data to ensure generic drug quality and safety, reflecting a maturing and increasingly complex generic market.

The Regulatory Labyrinth: Approvals in Key Markets

Navigating the regulatory landscape is perhaps the most daunting and complex aspect of generic drug development. Success in bringing a generic product to market hinges on a deep and nuanced understanding of the specific requirements and approval pathways established by key global agencies, notably the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulatory bodies serve as gatekeepers, ensuring that only safe, effective, and high-quality medications reach patients.

The U.S. FDA: Abbreviated New Drug Application (ANDA) Pathway

In the United States, generic drugs gain approval through the Abbreviated New Drug Application (ANDA) process. This pathway was strategically established by the Drug Price Competition and Patent Term Restoration Act of 1984, famously known as the Hatch-Waxman Amendments.8 The “abbreviated” nature of this application is a critical distinction: it means manufacturers are not required to repeat the extensive and costly animal and clinical trials for safety and efficacy, as these studies were already conducted and established by the Reference Listed Drug (RLD).4 This legislative framework was a deliberate policy mechanism to accelerate the entry of generic drugs into the market, thereby enhancing accessibility and affordability for patients.40

Instead of de novo clinical trials, an ANDA applicant must demonstrate that their proposed generic product is therapeutically equivalent to an already approved RLD.8 This involves providing comprehensive data confirming that the generic drug matches the RLD in several key aspects: active ingredients, conditions of use, method of administration, dosage form, strength, potency, labeling, and, most crucially, bioavailability and bioequivalence.8

The ANDA submission process involves several meticulously defined steps:

- Pre-ANDA Preparation: Before formal submission, sponsors undertake thorough preparatory work. This includes analyzing the RLD’s chemical composition, formulation, labeling, and regulatory history to ensure the proposed generic precisely matches the original drug.8 Critically, this phase involves conducting bioavailability and bioequivalence testing to demonstrate that the generic drug delivers the same therapeutic effect as the RLD.8 Manufacturers must also review their internal manufacturing standards to ensure compliance with Current Good Manufacturing Practices (cGMP) and familiarize themselves with all relevant FDA guidance documents and ANDA submission expectations to avoid common pitfalls.8

- ANDA Submission: The compiled application must be robust and comprehensive. It typically includes detailed drug formulation and composition details, descriptions of the manufacturing process and quality control measures, labeling information that is identical to the RLD (with only minor, allowable modifications), complete bioequivalence study results and analytical data, and comprehensive stability testing reports.8 A complete and well-documented application is absolutely vital to prevent delays in the review process.8

- FDA Review: Upon receiving the ANDA, the FDA initiates a multi-phase review. This rigorous assessment evaluates the submitted bioequivalence and safety data, scrutinizes labeling compliance with the RLD, and involves on-site inspections of manufacturing facilities to ensure quality assurance.8 This review process typically takes around 30 months, although applications for priority generics (e.g., drugs addressing shortages or unmet medical needs) may be expedited.8

- Decision: Following the comprehensive review, the FDA renders a decision. The agency will either approve the ANDA, thereby authorizing the generic drug for marketing, or issue a Complete Response Letter (CRL) if deficiencies are identified, requiring the applicant to address concerns before resubmission.8

The Hatch-Waxman Act created the ANDA pathway specifically to “accelerate the entry of generic drugs into the market, enhancing accessibility and affordability”.40 The “abbreviated” nature of the application avoids redundant clinical trials, which are inherently “time-consuming and costly”.8 This legislative framework is a direct policy mechanism designed to balance pharmaceutical innovation (through brand-name patent protection) with critical public health needs (through affordable generics). For business professionals, understanding this foundational intent helps in strategic planning beyond mere compliance. It emphasizes that the FDA’s goal is to facilitate market entry for quality generics, and engaging proactively (e.g., via Pre-ANDA meetings to clarify regulatory expectations 56) aligns with this objective, potentially speeding up approvals and reducing costs. It represents a system designed to benefit both industry (through a clearer, faster path) and patients (through increased affordability).

Intellectual Property and the Hatch-Waxman Amendments: Paragraph IV Certifications

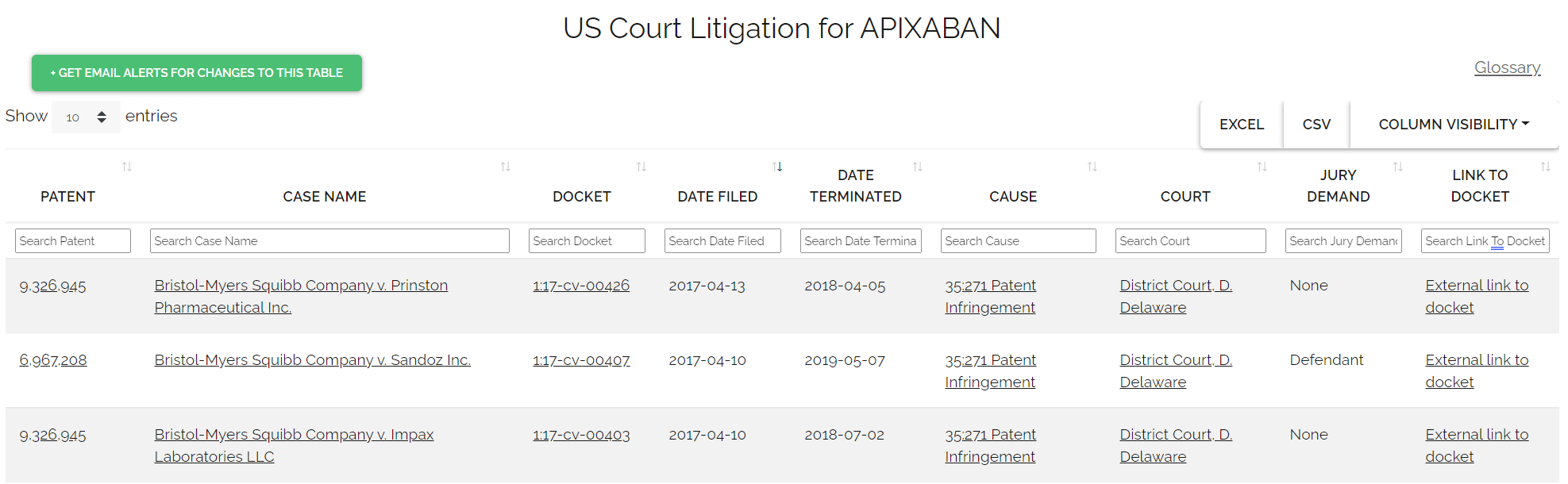

The Hatch-Waxman Amendments did more than just establish the ANDA pathway; they also created a complex and often litigious interplay between patent protection and generic drug entry.54 A generic company can strategically seek FDA approval to market a generic drug even before the expiration of patents related to the brand-name drug by filing a “Paragraph IV certification”.6

A Paragraph IV certification is a formal statement by the generic applicant asserting that, in their opinion and to the best of their knowledge, a brand-name patent listed in the FDA’s “Orange Book” is “invalid, unenforceable, or will not be infringed by the generic product”.6 This certification represents a direct legal challenge to the brand manufacturer’s patent rights.6

Upon filing an ANDA with a Paragraph IV certification, the generic applicant is legally obligated to notify both the brand product sponsor and any patent holders of their submission.6 If the brand company chooses to initiate patent infringement litigation against the generic applicant within a strict 45-day window, an automatic 30-month regulatory “stay” is triggered.6 During this period, the FDA is generally prevented from granting final approval to the generic application.6 This “30-month stay” provides brand manufacturers with significant procedural protection, allowing time for patent disputes to be resolved in court, and can potentially translate into hundreds of millions or even billions of dollars in protected revenue for the brand.6

However, the Hatch-Waxman framework also provides a powerful incentive for generic manufacturers to challenge brand patents through the coveted “180-day exclusivity period”.6 This exclusivity is granted to the

first ANDA applicant to file a Paragraph IV certification that is deemed “substantially complete” by the FDA.6 During this six-month period, the FDA will not approve subsequent generic applications for the same product, effectively creating a temporary duopoly between the brand and the first generic manufacturer.6 This exclusivity period can be the most profitable phase for the generic entrant, often allowing them to capture significant market share at prices only moderately discounted from the brand (typically 15-25% below brand pricing).6

The IP landscape for generic manufacturers is a high-stakes chess game. Paragraph IV certifications are explicitly designed to allow generic entry before patent expiry.54 However, this strategy triggers a 30-month stay if litigation occurs.6 Conversely, being the “first-to-file” with a Paragraph IV certification grants a lucrative 180-day exclusivity.6 Successfully navigating Paragraph IV challenges requires a robust legal strategy, deep patent analysis, and a willingness to engage in costly litigation.6 The incentive of 180-day exclusivity is a powerful driver for early market entry, but the risk of a 30-month delay due to litigation can significantly impact timelines and financial projections. Business professionals must carefully weigh the potential for massive profits against the legal costs and delays, making intellectual property strategy a core component of their overall market domination plan. This is a clear example of how legal and regulatory nuances directly shape market economics.

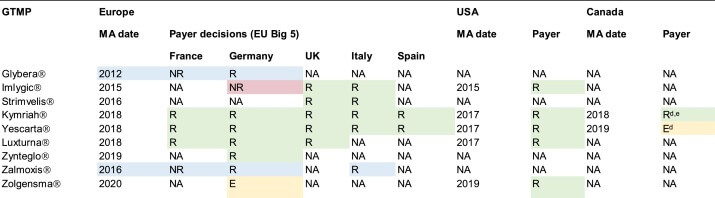

The European Medicines Agency (EMA): Marketing Authorization Application (MAA) Pathway

In the European Union, generic drugs seek approval through a Marketing Authorization Application (MAA) pathway, centrally overseen by the European Medicines Agency (EMA).57 Once granted by the European Commission, this centralized marketing authorization is valid across all EU Member States, as well as Iceland, Norway, and Liechtenstein.58 This single approval streamlines market access across a significant geographical and economic bloc.

The MAA process is a substantial undertaking, often requiring 18-24 months of intensive preparation by a large, multidisciplinary team, with overall strategic planning ideally commencing 2-3 years before the intended submission date.57 Applicants must meticulously determine the correct “legal basis” for their MAA, with Article 10 specifically covering “Generic, hybrid or similar biological application”.57 Each legal basis carries distinct requirements for the scope and type of data that must be collected and included in the MAA dossier.57

A critical and internationally harmonized component of the EMA MAA is the Common Technical Document (CTD) dossier.57 The CTD provides a standardized, five-module format for submitting scientific information, facilitating review and approval across multiple regulatory jurisdictions 59:

- Module 1: Contains regional administrative information, such as application forms, cover letters, and specific labeling requirements pertinent to the EU.59

- Module 2: Provides high-level summaries and overviews of the scientific information detailed in Modules 3, 4, and 5. This includes a Quality Overall Summary, Nonclinical Overview, and Clinical Overview.59

- Module 3 (Quality): This module details the chemistry, manufacturing, and controls (CMC) for both the drug substance and the drug product. It covers development, manufacturing processes, specifications, and comprehensive stability data.27 Applicants must prove the quality of active substances, ensure access to all relevant manufacturing information, and confirm excipient compatibility and impurity profiles.61

- Module 4 (Nonclinical Study Reports): Presents data from preclinical studies, such as pharmacology, toxicology, and ADME (absorption, distribution, metabolism, excretion) studies.59 For generics, extensive de novo nonclinical studies are generally not required, as the application refers to the reference product’s established safety data.35

- Module 5 (Clinical Study Reports): Contains data from clinical trials, which for generics primarily means bioequivalence studies.59 If bioequivalence is successfully demonstrated, no additional preclinical tests or clinical trials are needed.35 This module includes detailed pharmacokinetic data (e.g., Cmax, AUC) and rigorous statistical analysis, with the 90% CI for geometric mean ratios typically falling within the 80-125% acceptance range.35

Applicants are required to notify the EMA of their intention to submit an MAA, preferably 6-18 months in advance, and submit an eligibility request.57 Pre-submission meetings can also be requested to discuss specific aspects of the MAA dossier, providing an opportunity for early dialogue with regulators.57

While the CTD is explicitly called a “harmonized format” 59, intended to “improve organization of documents and therefore allows harmonization of data across different products” 61, it is important to note that regional variations still exist, especially concerning regulatory expectations, even within this harmonized framework.27 For example, the US FDA might demand more process validation data than the EMA.27 This means that a “one-size-fits-all” approach to dossier preparation, while appealing in theory, is insufficient in practice. Companies operating globally still need to be acutely aware of regional specificities, necessitating expert regulatory affairs teams who can navigate these nuanced differences.

Centralized vs. National Procedures for Generics

For generic and hybrid medicinal products, access to the Centralized Procedure is automatic if the reference product was centrally authorized.62 This means a single application covers the entire EU/EEA region, providing a streamlined path to broad market access.58

However, if the reference product was authorized via a national procedure, a Mutual Recognition Procedure (MRP), or a Decentralized Procedure (DCP), a generic applicant may still request consideration under the centralized procedure. This is typically granted if the applicant can demonstrate “significant therapeutic, scientific or technical innovation” or that the authorization is “in the interest of patients at Union level”.62 Such innovation could involve providing a new alternative treatment, leveraging new scientific knowledge, or employing a new technology in the development or manufacturing process.62

The choice of MAA pathway is a strategic decision for generic manufacturers that significantly impacts market reach and regulatory burden. While automatic access for centrally authorized RLDs simplifies the process, the ability to successfully argue “significant innovation” for a nationally authorized RLD can unlock the broader EU market. This highlights the importance of early regulatory strategy, assessing not just the scientific equivalence but also the market access implications of different procedural routes. It is a business decision as much as a regulatory one, requiring foresight and a deep understanding of European regulatory nuances.

A Tale of Two Regulators: Comparing FDA and EMA Approaches

While both the FDA and EMA share the fundamental goal of ensuring safe, effective, and high-quality medicines, their regulatory frameworks, approval pathways, and data emphasis can differ significantly.66 These distinctions are crucial for companies aiming for global market access and require tailored strategic approaches.

Approval Timelines and Data Requirements

Historically, the FDA has often authorized drugs earlier than the EMA, tending to utilize faster and more flexible approval pathways.66 The FDA may demonstrate greater tolerance for uncertainty in benefit-risk assessments and frequently relies on surrogate endpoints and limited clinical data, particularly in accelerated approval pathways.66 This approach can lead to quicker market entry in the U.S.

In contrast, the EMA generally demands more comprehensive clinical data, emphasizing larger patient populations and longer-term efficacy and safety follow-up.67 This often results in potentially longer approval times in Europe.67 The EMA’s regulatory philosophy often leans towards a stronger focus on long-term safety and broader public health priorities.66

A comparison of generic drug applications between 2017 and 2020 revealed a 95% concordance in application review outcomes for drugs submitted to both agencies by the same applicant, suggesting a reasonable alignment in final decisions.68 However, the sheer volume of applications differed dramatically: the FDA received a significantly higher number of generic applications (3,243) compared to the EMA (61) in that period.68 Furthermore, the approval timelines often varied by several years, with the FDA approving some generics years before the EMA. For example, the FDA approved tacrolimus, anagrelide, and paclitaxel generic drug products 8, 12, and 17 years, respectively, before the EMA.68

Regulatory Philosophy

The FDA often adopts a more “exploratory” approach to drug approvals, sometimes allowing for earlier market access based on promising, albeit less extensive, data.66 Conversely, the EMA is characterized as more “public health oriented,” prioritizing comprehensive data and long-term safety before granting marketing authorization.66 These divergent philosophies reflect different underlying risk tolerances and public health priorities.

This difference means that a truly global market entry strategy cannot be a simple replication of one region’s submission. It requires tailoring clinical trial designs, data packages, and even communication strategies to meet the specific expectations of each agency. Companies might prioritize FDA submission for faster initial market access, then adapt their data for the EMA’s more stringent requirements. This necessitates robust regulatory intelligence and flexible development programs, emphasizing the need for expert regulatory affairs teams who can navigate these nuanced differences.

Harmonization Efforts

Despite these differences, both agencies are actively engaged in harmonization efforts. A notable example is the FDA-EMA Parallel Scientific Advice (PSA) pilot program for complex generic/hybrid products.69 This program allows for concurrent consideration and joint exchange of views on scientific questions during the development phase, aiming to optimize product development and provide deeper understanding of regulatory decisions.70 Such collaborative initiatives seek to reduce duplication and inefficiency, ultimately benefiting global public health by accelerating access to quality medicines.

Table 2: Comparison of FDA ANDA vs. EMA Generic MAA Approval Pathways

To provide a clear, concise overview of the distinct regulatory pathways, the following table compares key aspects of the FDA’s Abbreviated New Drug Application (ANDA) and the EMA’s generic Marketing Authorization Application (MAA).

| Aspect | U.S. FDA (ANDA Pathway) | European Medicines Agency (Generic MAA Pathway) |

| Pathway Name | Abbreviated New Drug Application (ANDA) | Marketing Authorization Application (MAA) for Generics |

| Primary Legislation | Drug Price Competition and Patent Term Restoration Act of 1984 (Hatch-Waxman Act) 8 | Directive 2001/83/EC, Article 10 (Generic, hybrid or similar biological application) 35 |

| Scope of Approval | United States only | All EU Member States, Iceland, Norway, Liechtenstein (Centralized Procedure) 58 |

| Key Requirement | Bioequivalence to Reference Listed Drug (RLD) 8 | Bioequivalence to Reference Medicinal Product 35 |

| Typical Review Time | Approximately 30 months, with potential for expedited review for priority generics 8 | Varies, often longer than FDA due to more extensive data requirements; planning starts 2-3 years prior 57 |

| IP Protection Mechanism | Paragraph IV Certifications, 30-month litigation stay, 180-day first-to-file exclusivity 6 | Data exclusivity (usually 10 or 11 years from first authorization of reference product); no direct equivalent to Paragraph IV challenges or 180-day exclusivity 71 |

| Dossier Format | Common Technical Document (CTD) format, with U.S.-specific Module 1 requirements 59 | Common Technical Document (CTD) format, with EU-specific Module 1 requirements 59 |

| Emphasis on Clinical Data | Less extensive for generics, focused on BE; relies on RLD’s safety/efficacy data 4 | Less extensive for generics, focused on BE; EMA may demand larger datasets/longer follow-up for complex cases 35 |

| Post-Market Surveillance | FDA monitors FAERS (Adverse Event Reporting System) and MedWatch reports; periodic manufacturing plant inspections 36 | Decentralized pharmacovigilance system with country-specific compliance requirements; ongoing monitoring 67 |

| Number of Applications (2017-2020) | 3,243 generic drug applications approved 68 | 61 generic drug applications approved 68 |

The direct comparison of the two major regulatory bodies (FDA and EMA) is essential for a global perspective on generic drug development. While both agencies utilize the internationally harmonized CTD, their specific legal frameworks, intellectual property mechanisms, and nuances in data emphasis (even for generics) are distinct. This table clearly delineates these differences, which is critical for business professionals developing multi-market strategies. For companies planning to launch generics in both the U.S. and Europe, this table provides a quick reference guide to the different “rules of the game,” allowing them to anticipate varied requirements and potential timelines. The stark difference in the number of applications processed (3,243 vs. 61) 68 is a powerful data point that underscores the scale and focus of each agency’s generic program.

Strategic Imperatives: Challenges and Opportunities in Generic Drug Development

The generic drug industry, while vital for healthcare affordability and access, is not without its significant hurdles. It operates within a dynamic and intensely competitive environment, demanding strategic foresight and adaptability. However, within these challenges lie immense opportunities for those who can navigate them effectively and innovatively.

Overcoming Development Hurdles: Complex Generics and Regulatory Ambiguity

Not all generics are created equal. The category of “complex generics”—which includes products like injectables, inhalers, transdermal patches, or topical drugs—presents intricate challenges due to their sophisticated formulations, complex dosage forms, or specialized delivery systems.46 Replicating the exact characteristics of the reference drug for these products is inherently difficult, often requiring advanced scientific understanding and technological capabilities.46

Developing these complex products demands a higher level of expertise, more sophisticated planning, and often more nuanced methods and rigorous testing than is typically required for simple generics.50 For instance, proving bioequivalence when the branded drug utilizes a proprietary device or has a complex microstructure can be a significant hurdle.49 The FDA’s Center for Research on Complex Generics confirms that fewer complex generic products exist due to the difficulty in developing them with traditional bioequivalence methods, resulting in less market competition for these products.72

A major challenge for manufacturers in this space is the “lack of guidance” from regulatory bodies for complex generics.50 This regulatory ambiguity means developers must think strategically about their protocols, engage proactively with regulatory bodies, and design studies that address unique challenges while aiming for speed to market.56 This lack of clear guidance can lead to “costly delays” and “rejected applications,” as seen in a 2023 study where 20% of ANDA rejections stemmed from inadequate bioequivalence data.49 One miscalculation in a pivotal study can result in months of rework or even a complete restart, making precision non-negotiable.49

The inherent regulatory ambiguity in complex generics drives up costs and delays market entry, thereby creating a distinct niche for specialized expertise. The research explicitly states that complex generics are “harder to develop with traditional bioequivalence methods” and face “a lack of guidance,” leading to “costly delays” and “rejected applications”.46 This directly impacts time-to-market and profitability. This challenge, however, creates a distinct market segment for companies with specialized R&D capabilities and regulatory expertise in complex generics. It acts as a barrier to entry that, once overcome, can lead to less competition and potentially higher profit margins compared to saturated simple generic markets.7 For business professionals, this observation signals a strategic opportunity to invest in or acquire companies with proven track records in complex generic development, as this niche offers a path to “higher-value generics” 37 and significant market differentiation.

Fortifying the Supply Chain: Mitigating Quality and Availability Risks

The global generic drug supply chain is an intricate and often vulnerable web, with a significant portion of active pharmaceutical ingredients (APIs)—over 70%—sourced internationally.49 This globalization, while offering cost advantages, introduces substantial challenges, including inherent supply chain constraints, potential ingredient shortages, and manufacturing capacity issues.46

Quality Control Issues: Despite rigorous regulatory oversight, quality control issues can unfortunately arise within this complex global network. Recalls due to contamination, such as the alarming discovery of nitrosamine contaminants in certain Valsartan, Losartan, and Irbesartan formulations, highlight the persistent need for more robust and vigilant quality assurance measures.74 A former FDA medical officer was quoted, expressing a profound concern:

“Valsartan is just the one we caught. Who knows how many more are out there?” 74

This statement underscores the ongoing vigilance and proactive measures required to ensure the integrity of the global drug supply. The globalization of the supply chain has indeed made it more challenging for regulatory bodies like the FDA to maintain comprehensive quality oversight, particularly as many generic drugs are now manufactured overseas.75

To mitigate these critical risks and fortify the supply chain, several strategic approaches are being adopted and advocated:

- Multi-Sourcing: Diversifying suppliers for raw materials and APIs is a fundamental strategy. This reduces over-reliance on single sources, thereby enhancing resilience against potential disruptions like geopolitical tensions, natural disasters, or quality lapses from a sole supplier.47 Multi-tier supply networks with pre-screened supplier profiles make it easier to switch quickly when needed.47

- Digitization and Predictive Intelligence: Implementing advanced quality systems that digitize batch release processes and provide predictive insights can significantly improve supply chain responsiveness and reduce audit cycles.29 Cloud-based data platforms, for instance, have been shown to cut audit cycles by 40%.29 These tools enable real-time optimization and transparency, helping pharmaceutical companies navigate complex ecosystems.37

- Real-Time Visibility and Traceability: Achieving end-to-end visibility across all trading partners in the supply chain is crucial. This allows manufacturers to understand supplier activities at every step, identify vulnerabilities proactively, and ensure compliance with regulatory and quality standards.47

- Domestic Manufacturing: There is a growing “overall push to try to bring more manufacturing back to the United States”.3 This strategic shift aims to reduce quality concerns, mitigate shortages, and establish a more predictable supply and pricing environment.3 This is seen as a direct way to prioritize quality and build a resilient domestic supply chain, reducing dependence on foreign sources.51

- Quality Rating Systems: Proposals for drug-quality rating systems are gaining traction. Such systems could introduce greater transparency into quality management systems, rewarding manufacturers with robust quality systems that exceed minimum GMP standards. This would allow purchasers, including healthcare systems, to distinguish products based on their quality and reliability, incentivizing continuous improvement across the industry.76

In the past, generic supply chains might have been optimized purely for cost. However, recent events, such as drug shortages (which hit an all-time high of 323 in Q1 2024 3), and persistent quality concerns have fundamentally shifted this paradigm. Companies that proactively invest in resilient, transparent, and high-quality supply chains will gain a significant competitive edge. This is no longer merely about operational efficiency; it is about safeguarding brand reputation, ensuring patient safety, and guaranteeing consistent market supply, which can lead to preferred supplier status and long-term contracts. This transforms supply chain management from a traditional cost center into a strategic pillar for market domination.

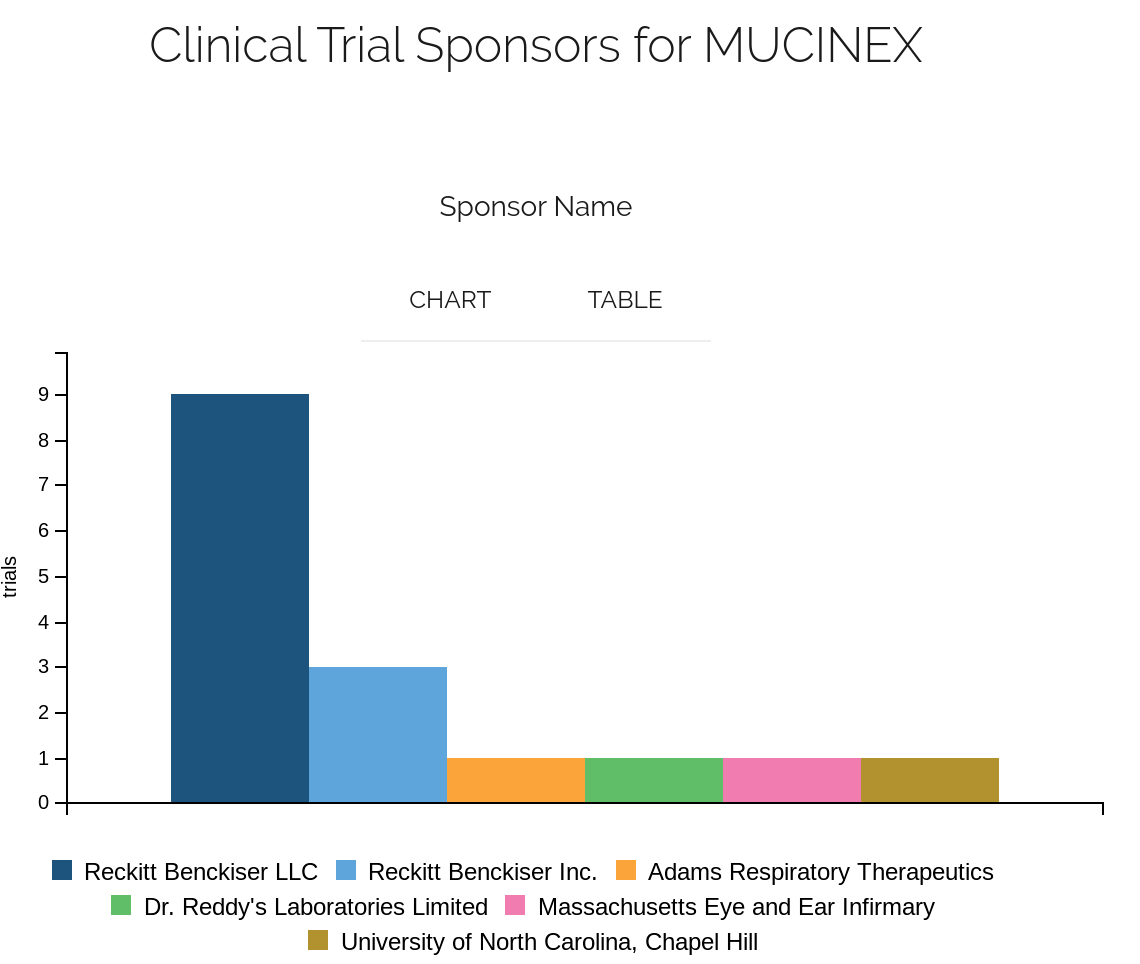

Leveraging Data and Technology: AI, Analytics, and Process Optimization

The pharmaceutical industry is undergoing a profound digital transformation, with data analytics and advanced technologies playing an increasingly pivotal role across the entire generic drug development lifecycle. This technological integration is reshaping how drugs are discovered, developed, manufactured, and regulated.

Accelerating R&D and Manufacturing

The application of data and technology is significantly accelerating processes in research and development, and manufacturing:

- Data Analytics: Companies are leveraging advanced data analytics to accelerate drug discovery, optimize manufacturing operations, and minimize errors.77 Real-time monitoring and sensor analytics enable the detection of even small deviations during production, allowing for immediate process optimization and improved quality control.77 For example, Pfizer’s collaboration with AWS is developing a solution using AI and machine learning to detect anomalies and identify their root causes in continuous clinical manufacturing.77

- Artificial Intelligence (AI) and Machine Learning (ML): AI is being integrated across every phase of the drug product lifecycle, from nonclinical and clinical studies to post-marketing surveillance and manufacturing.78 The FDA itself is at the forefront of leveraging AI to advance generic drug development, actively developing tools such as the Bioequivalence Assessment Mate (BEAM). BEAM aims to automate labor-intensive tasks, enhance data collection, and significantly improve the overall efficiency of the bioequivalence assessment process.37 Beyond this, AI and predictive analytics can proactively flag potential bioequivalence study flaws or identify impending supply chain disruptions before they occur, enabling timely interventions.49 One company reportedly slashed its ANDA review cycles by 25% using AI to pre-check data.49

- Advanced Manufacturing Technologies (AMTs): The industry is increasingly adopting cutting-edge manufacturing technologies such as 3D printing and continuous manufacturing, alongside broader automation initiatives.23 These technologies promise substantial benefits, including reduced production costs, accelerated time-to-market, and enhanced quality control through real-time monitoring.23 Continuous processes, in particular, minimize interruptions and maximize output, and the FDA has explicitly highlighted their potential to prevent drug shortages by improving manufacturing resilience.25 As Cynthia Fanning, Vice President at GE Appliances, noted, “To be competitive, we have to look for every opportunity to improve efficiencies and productivity while increasing quality”.24

Streamlining Regulatory Affairs

The impact of data and technology extends profoundly into the realm of regulatory affairs, streamlining complex submission and review processes:

- Digital and Analytics Tools: Digital and analytics tools are helping pharmaceutical companies become more agile and resilient by efficiently capturing raw data, providing real-time optimization and transparency, and simplifying the navigation of complex regulatory ecosystems.37

- FDA Initiatives: The FDA’s Innovative Science and Technology Approaches for New Drugs (ISTAND) program is designed to encourage the development of novel drug development tools, including digital health technologies. This initiative aims to centralize discussions around drug development, foster shared knowledge within the FDA, and provide standardized recommendations to assist external parties, ultimately speeding up decision-making and advancing the understanding of drugs.37

- Quantitative Methods and Modeling (QMM): QMM, encompassing tools like physiologically based pharmacokinetic (PBPK) modeling and computational fluid dynamics (CFD) modeling, is increasingly utilized by the generic drug industry. These methods support development and Abbreviated New Drug Application (ANDA) regulatory assessments, with the potential to minimize or even eliminate the need for costly and time-consuming in vivo studies to establish bioequivalence.56 The FDA recognizes the evolving role of model-informed evidence (MIE) in generic drug development and is exploring frameworks for efficient model-sharing and acceptance.79

The pervasive integration of AI, machine learning, and data analytics across R&D, manufacturing, and regulatory affairs 23 is not just an optional enhancement; it is becoming a fundamental requirement for generic drug companies to remain competitive. Those who fail to adopt these technologies risk being outpaced by more agile competitors who can bring products to market faster and at lower costs. For business professionals, this means strategic investment in digital infrastructure, data science talent, and advanced manufacturing capabilities is no longer a luxury but a strategic imperative for long-term market domination. It is about transforming operations to gain a decisive edge in a price-sensitive and highly regulated market.

The Future of Generics: Market Dynamics and Evolving Landscape

The generic drug market is not a static entity; it is a dynamic and continuously evolving ecosystem, profoundly shaped by persistent economic pressures, rapid technological advancements, and the ever-changing landscape of patient needs. A thorough understanding of its current trajectory and future outlook is paramount for strategic planning and sustained success within this critical sector of the pharmaceutical industry.

Market Growth and Economic Impact: Billions in Savings

The global generic drugs market is poised for significant and sustained growth. Projections indicate an estimated market size of USD 515.07 billion in 2025, with an expected surge to approximately USD 775.61 billion by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.25%.5 Another analysis estimates the market to reach USD 682.9 billion by 2030, with an impressive 8.3% CAGR from 2023-2030.73

This substantial growth is primarily fueled by several interconnected factors: the ongoing expiration of patents on blockbuster brand-name drugs, favorable judiciary decisions that support generic entry, and a relentless increase in global demand for affordable medications.5 Governments and insurance providers worldwide actively promote the use of generics as a key strategy to reduce overall healthcare expenditure, recognizing their pivotal role in cost containment.5

The U.S. market alone exemplifies this trend, with an estimated size of USD 138.18 billion in 2024, projected to reach USD 188.82 billion by 2033.5 North America held the largest market share globally, accounting for 36.19% in 2024.5

The economic impact of generics is undeniable and transformative. Generic drugs saved the U.S. healthcare system a staggering $373 billion in 2021.1 Despite accounting for a remarkable 91% of all U.S. prescriptions filled, these medications represent only 18.2% of the country’s total spending on prescription drugs.1 This stark contrast powerfully highlights their immense value in driving down healthcare costs and improving accessibility.

The robust market growth projections, consistently linked to patent expirations and the inherent cost-effectiveness of generics 5, indicate a stable and expanding market for generic drug manufacturers. This growth is driven by fundamental economic and public health imperatives that are unlikely to diminish. For business professionals, this signifies a fertile ground for strategic investment and expansion, particularly in regions with growing healthcare needs and upcoming patent cliffs. The market is not just growing; it is becoming an increasingly indispensable component of global healthcare systems.

Emerging Trends: Biosimilars, Advanced Manufacturing, and Digital Transformation

The generic landscape is continuously evolving, expanding beyond the traditional small-molecule generics that have historically dominated the market. This evolution is driven by innovation and a strategic shift towards higher-value products and more efficient processes.

- Biosimilars: These are highly similar, generic versions of complex biologic drugs, and they represent a significant and rapidly expanding growth opportunity within the pharmaceutical industry.23 Biosimilars are poised to revolutionize the treatment of complex conditions such as cancer, autoimmune diseases, and diabetes, offering cost-effective alternatives to often prohibitively expensive biologics.23 The market for biosimilars continues to expand, with their average sales price being approximately 50% less than that of the reference brand biologic.1 This provides substantial savings and increases patient access to life-changing therapies.

- Advanced Manufacturing Technologies (AMTs): The industry is increasingly embracing AMTs, including cutting-edge techniques like 3D printing and continuous manufacturing, alongside broader automation initiatives.23 These technologies promise a multitude of benefits, such as reduced production costs, accelerated time-to-market, and significantly improved quality control through real-time monitoring capabilities.23

- Digital Transformation: The integration of artificial intelligence (AI) and machine learning (ML) across drug discovery, production, and regulatory processes is a pivotal trend shaping the future of generics.23 AI-driven drug formulation and automation are actively contributing to reduced development costs and accelerated timelines.23 The FDA, recognizing this potential, is actively exploring the use of AI and data analytics to expedite data collection and preparation within its assessment processes, further streamlining approvals.37

- Sustainability: Beyond efficiency and cost, the generic drugs industry is also demonstrating a growing commitment to more sustainable practices in both production and packaging. Companies are increasingly focusing on reducing waste, minimizing energy consumption, and lowering carbon emissions, aligning with global environmental objectives.23

While “simple generics” still hold a dominant share of the market 73, there is a clear and accelerating emphasis on the “rise of biotechnology and biosimilars” 23 and “complex generics” 72 as key growth areas.23 These products, unlike simple generics, require “significant R&D investments and expertise”.7 As the market for simple generics becomes increasingly saturated and competitive, leading to “razor-thin profit margins” 24, generic companies are strategically shifting towards these more complex and higher-value product categories. This move allows them to capture greater value, differentiate themselves in the market, and escape the intense pricing pressures characteristic of commoditized segments. For business professionals, this indicates that future growth and profitability in the generic sector will increasingly stem from mastering the development and regulatory pathways for these more challenging, yet lucrative, drug categories.

Expert Perspectives on the Road Ahead

Insights from industry leaders and regulatory officials offer a valuable compass for understanding the future trajectory of the generic drug market. Their perspectives highlight both persistent challenges and strategic priorities.

Supply Chain Resilience and Domestic Manufacturing: Brent Eberle, president of CivicaScript, consistently highlights drug shortages as a “huge concern” for the industry.3 He emphasizes a growing push to bring more manufacturing back to the U.S. to ensure “fewer quality concerns, fewer shortages, and a more predictable supply and pricing”.3 He stresses the critical importance of ensuring an adequate supply: