Navigating 340B Program Changes in 2025

Proxsys Rx

APRIL 1, 2025

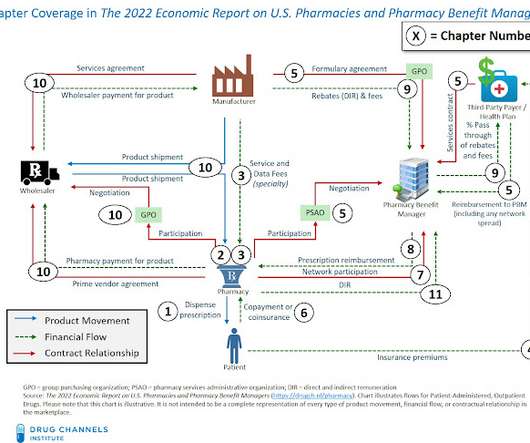

billion annually because of these restrictions, as drug companies limit 340B discounts on medications purchased through contract pharmacies. billion in 340B savings is at risk, due to increasing limitations imposed by pharmaceutical manufacturers which could further strain the healthcare safety net and patient care services.

Let's personalize your content